How Taking Advantage of Debt Relief Services Can Help Repair Your Finances

The winter holiday season including Thanksgiving, Christmas, and New Year’s Day is often considered the “most wonderful” time of the year; however, it’s also considered the most expensive.

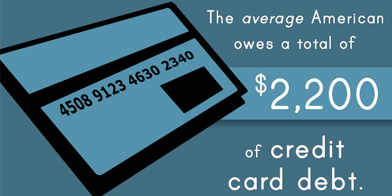

While credit cards account for just 5.5% of the total debt in the U.S., according to Statistic Brain, the average American owes a total of $2,200 of credit card debt. Statistic Brain also revealed that the average American household carries $117,951 of total debt.

Between holiday shopping, parties, and feasts, it’s incredibly easy to rack up more credit card debt than you wanted, especially if you’re not careful in creating a holiday budget or spending plan. Come tax season, you may find yourself scrambling to file your taxes as soon as possible in order to pay down your debts.

Luckily, there are a variety of flexible debt solutions that can help you not only get out of debt, but stay out of debt.

Debt relief programs offer a number of debt relief services that can be catered to accommodate your individual financial needs and goals. It’s critical not to prejudge your financial situation or give into thoughts of hopelessness or despair. It’s never too late to get the ball rolling on getting out of debt.

Debt relief services often involve working directly with an experienced debt counselor, who will carefully review the current state of your finances in addition to your income. Once an accurate debt-to-income ratio is established, the counselor will then recommended different debt relief options. Common options include debt settlement or debt management.

While these options vary in regards to their terms, both provide the opportunity to pay down your debt within your means.

In addition to establishing a plan of action to get out of debt that fits within your finances, debt counselors also provide expert financial planning advice in order to give you the tools and resources needed to prevent making financial mistakes and to make better financial decisions in the future.

Back to blog