How a Debt Relief Agency Can Allow You to Reach Your Financial Goals and Live Debt Free

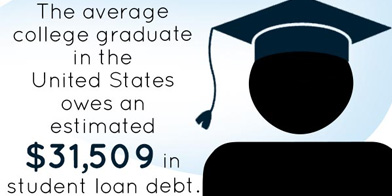

Debt is something that thousands of Americans struggle with. Even though we are roughly seven years post-recession, many American consumers are still grappling with its devastating effects, and struggling to manage student loan, medical, and credit card debt. As such, many are turning to debt relief companies seeking help with debt, as well as debt advice in order to plan for their futures.

Debt relief centers have experience working with all kinds of financial backgrounds and histories. There’s debt solutions and debt relief programs for every financial situation, no matter how bad. Typically, many people find that the hardest part of getting out of debt is working up the courage to ask for help. Debt carries many social stigmas that are founded on ignorance, fear, and lack of information; however, debt counselling can easily alleviate these insecurities.

Another issue some debtors encounter is unscrupulous organizations. As reported in the Bellingham Herald, one such company, known as Mission Settlement Agency, managed to rip off 1,000+ people; its founder, Michael Levitis, recently received a hefty fee and jail time as well for his crime.

While enrolled in a debt management program or debt repayment plan, debt calculators are extremely helpful in determining how long it will take to pay off your debt. Also, a debt calculator gives you the gratification of physically seeing how many months are left on your repayment program. Using a debt calculator will also allow you to budget easier and plan for the future.

Many people find that getting out of debt is easier then they initially thought, and are able to make better financial decisions in the future after getting debt help.

Back to blog